Goldfinch Update #14

A top DeFi Safety rating, Gemini, Polygon, and others cover Goldfinch, GIP-10 passes Snapshot, and more

🎙️Highlights of the week

DeFi Safety re-evaluated Goldfinch’s Process Quality Review score, placing it amongst the most secure of all rated DeFi protocols. View the report here.

Warbler Labs is hosting its next Town Hall in the Goldfinch discord on June 2nd at 9:00 AM. RSVP here.

GIP 10: Remove 12-month Vesting Requirement for Senior Pool Liquidity Mining recently passed on Snapshot. Read about the proposal here.

👀 From the Beak

Protocol security rating agency DeFi Safety re-evaluated Goldfinch’s security rating following the publication of Goldfinch’s updated Developer Docs, with the new 93% rating putting the protocol as one of the most secure in the industry. The report specifically calls out the strength of Goldfinch’s documentation on flashloan attack vectors and frontrunning, among other strengths. View the full report on the DeFi Safety site here.

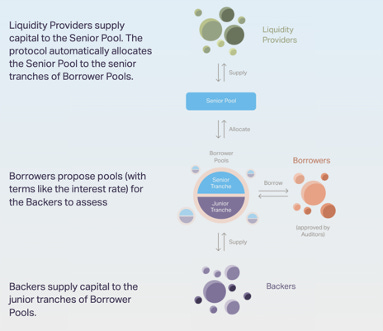

Gemini’s Cryptopedia published an article by Co-Founder and Warbler Labs CTO Blake West, “Goldfinch (GFI): Crypto Loans for the Real World.” The piece covers what sets Goldfinch apart from other crypto lending protocols, the different parties involved in its functionality, how the ‘trust through consensus’ mechanism works, and how the protocol allows access to capital in a way that is largely inaccessible in the traditional lending industry. Read more in the Cryptopedia.

GIP-10, the governance proposal to remove the 12-month GFI unlock schedule of Senior Pool Liquidity Mining, has passed Snapshot voting and moved on to the Governance Council approval phase. The proposal was written to ensure the changes will not hurt existing FIDU stakers in any way compared to new stakers, and to ensure a controlled release of GFI instead of a significant jump at one time. Learn more in the governance proposal, or view the voting results on Snapshot.

📰 Goldfinch in the Media

Crypto author and Variant Investor Spencer Noon covered Goldfinch in a thread on the shift of stablecoin yields to credit protocols that offer off-chain investment. The thread featured and was inspired by an article written earlier in the week, “The Crypto Loan Economy,” by analysts Jack and 0xlol for Polygon analytics. The article covered how DeFi is changing the history of the world’s lending-borrowing dynamic, risk assessment, and Goldfinch’s design amongst other credit protocols.

Goldfinch was listed on The Dapp List’s Curation & Buidl Launch Pad this week. View the listing here.

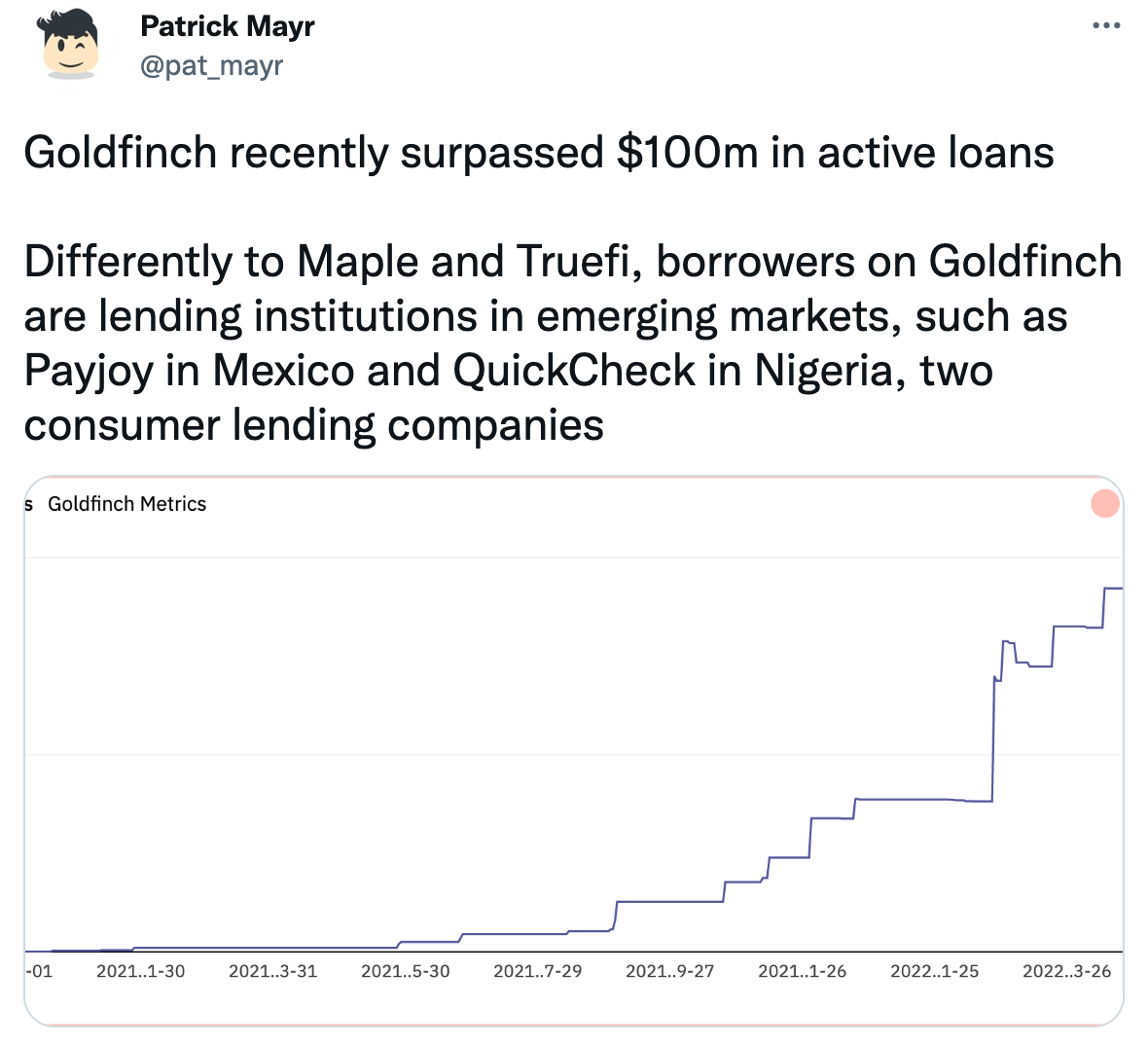

Cherry Crypto author Patrick Mayr wrote a thread and blog post on DeFi lending, covering Goldfinch, Maple, TrueFi, and the protocol’s differences in design and implementation.

hufhaus9 explored DeFi’s value in the light of the recent market crash, and highlighted Goldfinch as a promising protocol for investors like him. Read it here.

📅 Events

Upcoming:

Warbler Labs Town Hall – June 2nd, 2022 at 9:00 AM:

🗳️ Governance Proposals & Protocol Updates

Any $GFI holder can make a Goldfinch Improvement Proposal (GIP) via the process here. Voting costs nothing and happens through Snapshot.

GIP-10 Remove 12-month Vesting Requirement for Senior Pool Liquidity Mining

Community voted in favor of this proposal — it is now awaiting Council’s approval.

GIP-12: Compensate users who received fewer GFI rewards due to StakingRewards bug

This proposal is now live for discussion – contribute your thoughts here.

🎱 Senior Pool / Borrower Pool Updates

Current Senior Pool APY: 22.27% combined (9.81% USDC + 12.46% GFI)**

Get real-time updates when new Backer Pools launch, and news on upcoming Borrowers, here.

The Senior Pool is automatically diversified across different Borrower Pools. Backers can invest in specific Borrower Pools, and earn an additional share of rewards for their role doing so. Pools normally close for Backer deposits within a week. Learn more here.

📊 Stats

Defaults in the last 30 days: 0

Repayments in the last 30 days: ~$759K USD ($759,097.03)

Protocol Revenue in the last 30 days: ~$204K USD ($204,868.44)

Total Active Loans: ~$102M USD ($102,219,761.57)

See more data on Dune

❓FAQs

How often do I receive interest after investing as a Backer in the Borrower Pools? Do I receive interest daily across a week?

You will receive interest whenever Borrowers make repayments. Assume that there are two Backers to a Borrower Pool, and a Borrower pays back $100 in interest payments. This interest will be divided amongst all the Backers in the pool i.e. everyone will receive $50 (since there are two Backers).

🧠 More Info

📚 Want to get started? Read our simple protocol guide.

☕ Book a slot to chat with Warbler Labs team members here.

💰 Want to deposit capital in the protocol, but would rather chat with a human face first? Fill our form here and our team will get back to you.

🛠️ Find job openings for different positions at Warbler Labs here. Come Buidl with us!

📗 Read our Borrower Profiles here, and view the protocol’s pipeline of upcoming Borrower Pools here.

🐦 Follow us on Twitter, join our Discord, and see the latest governance activity on Discourse.

**Disclaimer: All APYs on Goldfinch are dynamic, and these APYs are a snapshot from 05.26.2022. The Senior Pool APY changes based on the amount of capital in, and the utilization rate of, the Senior Pool.