Goldfinch Update #46

🐦 Goldfinch Closes its First Callable Loan for Fazz, a Singapore-based Fintech

🎙️Highlights of the Week

Closed Fazz pool, 1st callable loan on Goldfinch - read more on Medium

Tune in here for our TwitterSpaces recording about this deal and accompanying memo

Axios writes about DeFi’s Real World Assets and features Goldfinch

Hear why Goldfinch is cool! Latest appearance by Co-Founders Mike and Blake on the Green Pill Podcast

We always enjoy meeting the Goldfinch Community - NFT NYC

🤠 Consensus in Austin anyone? Come meet Taylor and Po On

👀 From the Beak

Goldfinch Closes its First Callable Loan for Fazz, a Singapore-based Fintech!

Fazz Financial is a Singapore-based Series C Fintech backed by Y Combinator (S17), Tiger Global, and prominent Angel investors. Proceeds from the deal will be used as on-lending capital to grow its micro, small and mid-size enterprises (MSME) loan book.

Goldfinch raised a USDC 1.35 million loan to Fazz, a Singapore-based Series C Fintech backed by Tiger Global. This deal marks the first time that Goldfinch has offered a callable loan.

In this deal, Fazz Financial issued a 90-day callable loan with a fixed 13% USDC APY to Goldfinch’s pool of backers. Lenders usually have to sacrifice yield for the benefit of the call option. However, due to today’s constrained credit environment, this deal was executed with both the callable feature and an above-market yield.

Closing the first callable loan is a great milestone for the protocol, and the Goldfinch community is grateful to the backers who participated in this deal and trusted Fazz with their capital. Goldfinch believes that this new structure showcases its ability to provide flexible financing solutions to balance the needs of on-chain investors and off-chain borrowers. Full blog post here.

Fazz Credit Memo and TwitterSpaces AMA Recording

With our latest pool launch, we also had a third-party credit analyst produce a comprehensive credit memo synthesizing the data room information into a multi-page summary. In case you missed it, you can still read the memo directly here (Executive Summary and Full Memo). We hosted a TwitterSpaces last week about the Fazz Credit Memo to go behind the scenes on this Credit Analysis initiative to help educate investors and leverage the community's expertise in credit - catch the recording here.

📰 Goldfinch in the Media

Goldfinch in latest Axios Newsletter on DeFi’s Real World Assets

1 big thing: Goldfinch featured in the latest Axios newsletter by Crystal Kim, Brady Dale on how (DeFi) credit protocols are billed as the next frontiers of lending because they're figuring out how to get cash to small businesses that would otherwise go unserved.

"Lending protocols were loaning to market makers and traders, so their borrowing needs and returns were tied to the market," Mike Sall, co-founder and chief of Goldfinch said."We took a different approach, more longer term, going to borrowers who were not tied to crypto."

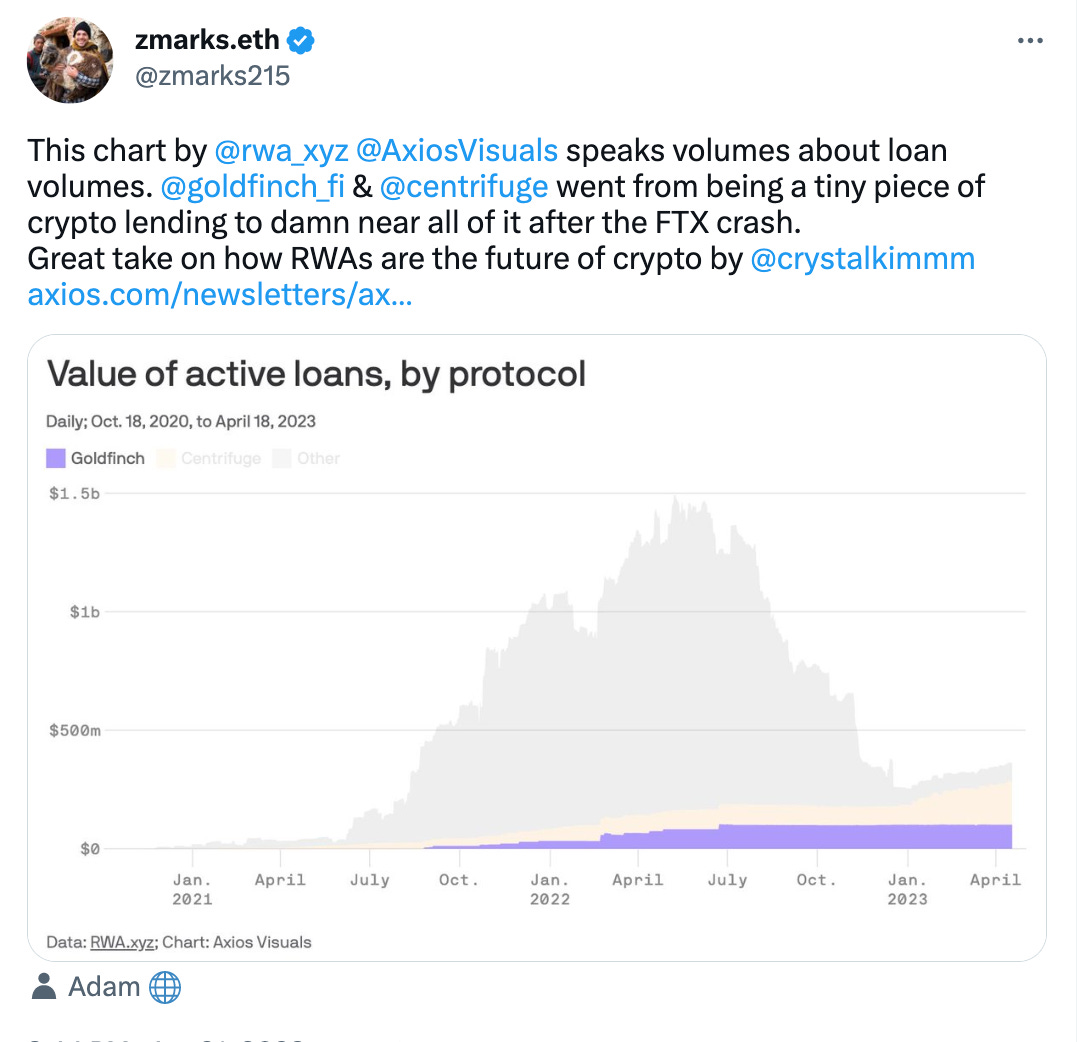

🐢This is a turtle race, Crystal writes. The value of active loans on lending protocols that deal in real-world assets is a shell of what it used to be, but perhaps volumes are returning, albeit slowly.

Green Pill Podcast with Kevin Owocki

In this latest episode, Kevin interviews Goldfinch Co-Founders Mike and Blake and shares a few reasons why he’s excited about the Goldfinch protocol. Goldfinch is cool because it:

1) Disrupts the old financial system

2) Legitimizes crypto

3) Provides to capital to small businesses that are growing

All of this being very “ReGen!”

Featured in CeFi Wire - Blockchain Callables are now a thing

Goldfinch’s innovative callable loan structure caught the attention of many and was featured in this CeFi Wire publication last week.

👂From the Community: Tweets and Pics

Thanks to those that stopped by the NFT NYC panel on Real World Assets last week and came to talk to the Goldfinch contributing team.

The panelists covered ways they’re bringing traditional finance on-chain and for Goldfinch, how we do private debt through blockchain.

📅 Events

We had our Monthly Founders AMA in Discord - make sure to mark your calendars for 3rd Friday of the month and follow along for updates

Warbler Labs Team Members Taylor and Po On will be in Austin at Consensus next week to spread the Goldfinch charm 🤠

We always have events in the works, from education to early alpha, so make sure to stay tuned, by following @goldfinch_fi on Twitter, or in the Goldfinch Discord.

🗳️ Governance

Any $GFI holder can make a Goldfinch Improvement Proposal (GIP) via the process here. Voting costs nothing and happens through Snapshot.

Proposals Passed

GIP-45: Templatize legal agreements for deals *note this did not pass quorum on snapshot, thus we will repost next week following the community approved cool-down period. Be on the lookout to vote!

Summary: Pay up to 70,200 USDC from the Goldfinch treasury to Reed Smith for a loan agreement template that can be used by borrowers for Goldfinch deals. The template aims to adapt traditional debt mechanics for on-chain mechanisms, standardize deal terms and reduce deal execution cost and timelines.

We welcome discussion and ideas for new Governance Improvement Proposals - head over to our #proposals-idea channel in Discord

🎱 Senior Pool / Borrower Pool Updates

Current Senior Pool APY: 13.6% combined (7.8% USDC + 5.8% GFI)**

Get real-time updates when new Backer Pools launch, and news on upcoming Borrowers, here.

The Senior Pool is automatically diversified across different Borrower Pools. Backers can invest in specific Borrower Pools, and earn an additional share of rewards for their role doing so. Pools normally close for Backer deposits within a week. Learn more here.

📊 Stats

Total loss rate in the last 30 days: 0

Repayments in the last 30 days: ~$1M USD ($1,058,599.10)

Protocol Revenue in the last 30 days: ~$121K USD ($120,706.20)

Total Active Loans: ~$101M USD ($101,344,765.11)

See more data on Dune

🧠 Resources

📚 Ready to start investing? Read the step-by-step guide.

💰 Considering providing capital to the protocol, but would prefer to chat with a human first? Complete the Goldfinch Capital Provider Interest Form here.

🛠️ Find job openings for a variety of roles building for Goldfinch at Warbler Labs here.

📗 Read Borrower Profiles here, and view the protocol’s pipeline of upcoming Borrower Pools here.

🐦 Follow us on Twitter, join our Discord, and see the latest governance activity on Discourse.

**Disclaimer: All APYs on Goldfinch are dynamic, and these APYs are a snapshot from 4.21.2023. The Senior Pool APY changes based on the amount of capital in, and the utilization rate of, the Senior Pool.